32+ Irs Offer In Compromise Calculator

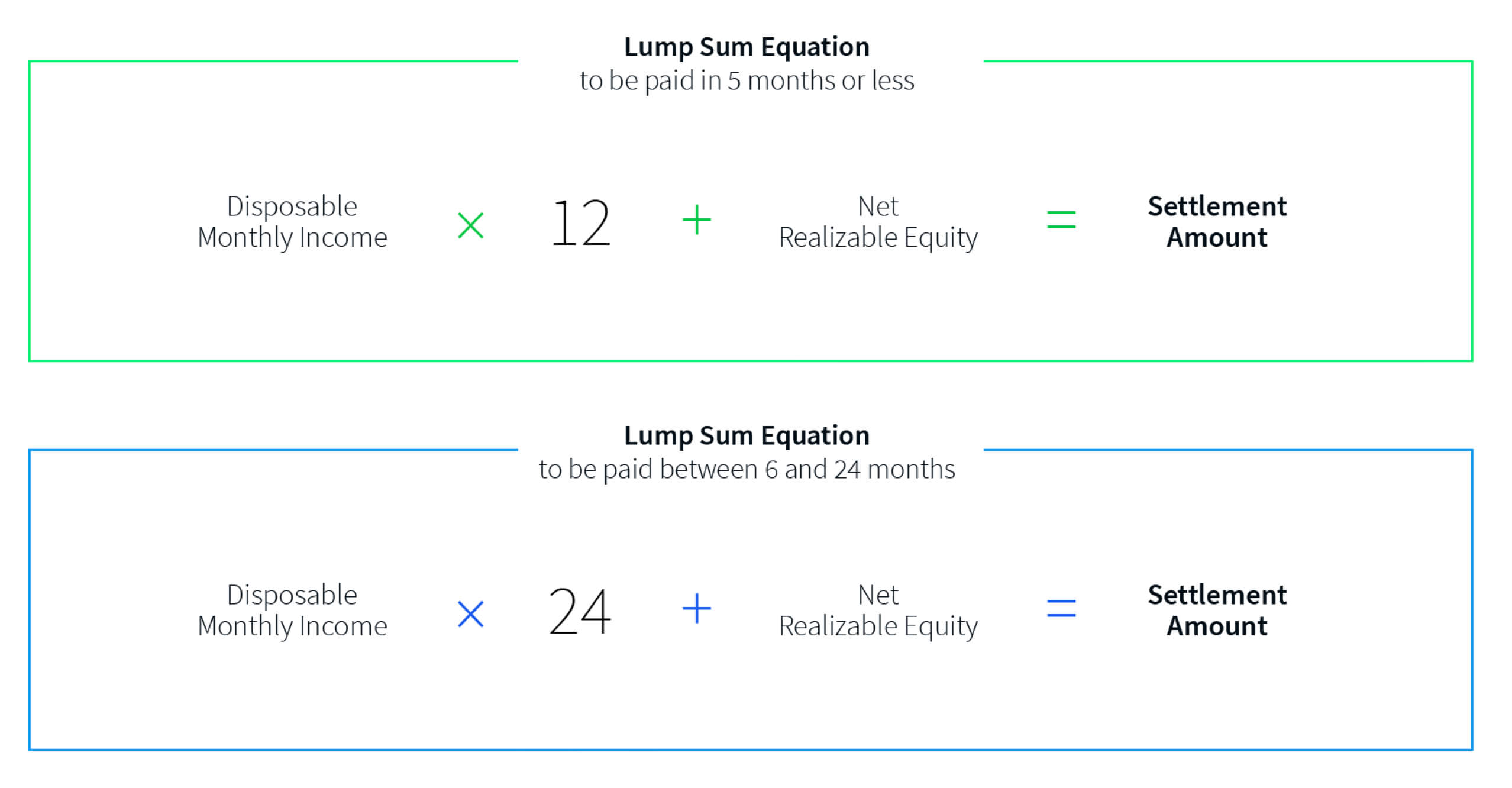

Available income per month x 12 amount of available assets based on Form 433-A OIC Amount IRS will accept for an Offer In. The IRS program for settling for less tax than you owe is called.

How Much Should You Offer In Compromise It Depends On A Lot Of Factors Learn More About Offer In Compromise Amounts At Community Tax

This calculator will estimate whether youre eligible for an IRS Offer in Compromise and if so potentially how much the offer will be.

. Enter your financial information and tax filing status to calculate a preliminary offer amount. How much do you owe the IRS. Step 1 of 7.

EXACTLY How Much to Offer to the IRS. Whether the Offer in Compromise IRS a ccepts or rejects depends on your applications unique facts and circumstances. We make our final.

- YouTube 000 10234 CHOICE TAX RELIEF Offer in Compromise Guidelines Formula. Acceptance of your Offer in Compromise. Less than 10000.

An IRS Offer in Compromise Calculator Boosts Chances of Acceptance. First Step of the Offer in. An offer in compromise will be considered withdrawn when Treasury receives a letter from the taxpayer withdrawing the offer.

The IRS will keep any tax refund including interest due. Use this tool to see if you may be eligible for an offer in compromise OIC. If your offer in compromise is accepted.

Contact ALG Tax Solutions for a customized tax solution. While researching the offer in compromise you may have found suggestions about hiring a tax attorney for legal advice and help with filling out your offer in compromise. Offer in Compromise Guidelines Formula.

You must pay the offer amount in accordance with the terms of your acceptance agreement. For qualifying taxpayers an Offer in Compromise allows. Read on to learn how to calculate your Available Monthly Income and Value of Personal Assets so you can determine your Offer in Compromise amount.

This calculator is for estimate purposes only. We offer in compromise calculator is calculate if an. An Offer in Compromise allows taxpayers to negotiate and settle their tax debt with the IRS for less than they owe for a fresh start.

This calculator is for estimation purposes only. If you determine that an Offer in Compromise is best for your client the next step is determining the. Offer in Compromise Calculator.

The formula for this case is disposable income per month x 2 plus. We now offer a calculator to help determine if you qualify to pay less tax than you owe. Do You Qualify for an IRS Offer in Compromise.

The formula for this one is. Use Our Offer in Compromise Calculator and Find Out Today.

Irs Offer In Compromise Calculator Alg Tax Solutions

Irs Tax Settlement Calculation Irs Offer In Compromise Tax Lawyer

Compute Gazette Issue 22 1985 Apr By Zetmoon Issuu

How Much Should You Offer In Compromise It Depends On A Lot Of Factors Learn More About Offer In Compromise Amounts At Community Tax

Accepted Offer In Compromise 3 Wolf Tax Tax Attorney

5 8 3 Centralized Offer In Compromise Transfers Perfection And Case Building Internal Revenue Service

Irs Offer In Compromise Formula How The Irs Calculates Tax Settlements Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Phoenix Az Irs Offer In Compromise Tax Debt Advisors

Irs Collection Alternatives Offer In Compromise Youtube

How Does The Irs Calculate My Reasonable Collection Potential For An Offer In Compromise Jackson Hewitt

How To Get An Offer In Compromise From The Irs Detailed Instructions Youtube

Irs Offer In Compromise Formula How The Irs Calculates Tax Settlements Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Offers In Compromise How Much Will The Irs Usually Settle For Supermoney

Nktx 10k 20201231 Htm

How Much Should I Offer In Compromise To The Irs Heartland Tax Solutions

How The Csed Can Affect Your Irs Offer In Compromise Youtube

Offer In Compromise Guide Canopy