Lifetime allowance

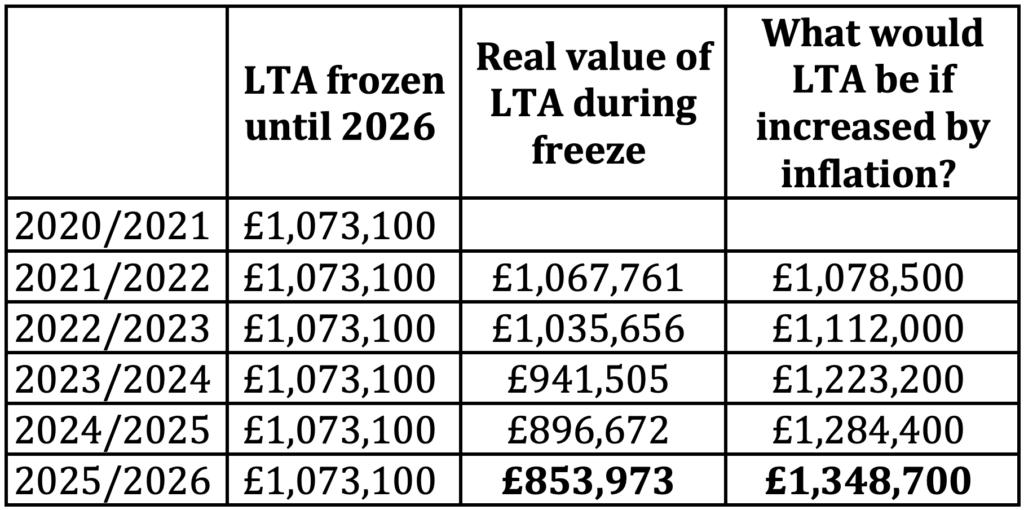

The other is the annual allowance and caps the amount you can save into. From 201819 the lifetime allowance increased every year by inflation as measured by the Consumer Prices Index rate the previous September.

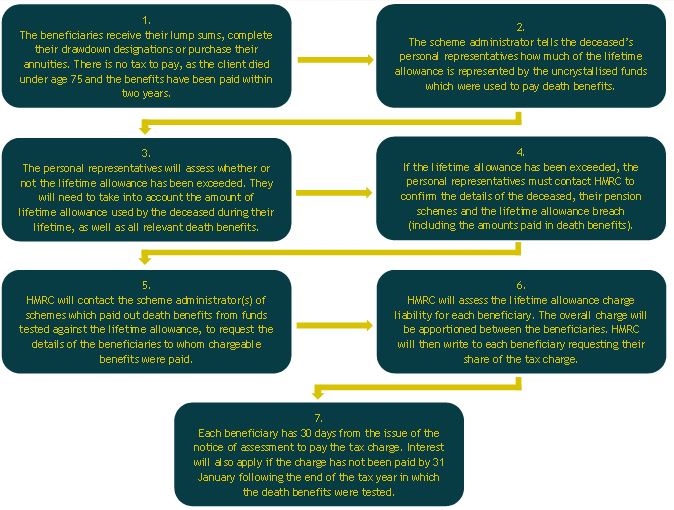

Paying A Lifetime Allowance Charge From Death Benefits Curtis Banks

The change removes a 55 per cent.

. In September 2019 inflation stood at 17. Web Setting the standard Lifetime Allowance from 2021 to 2022 to 2025 to 2026 Who is likely to be affected. The current standard LTA is 1073100 and is frozen at this level until April 2026.

Ask your pension provider how much of your lifetime allowance youve used. Read on to find out more about how this lifetime pension limit may affect you so you dont face an unexpected tax charge in 2021. The chart below shows the history of the lifetime allowances.

Web The lifetime allowance is the total amount you can build up in all your pension savings not including the state pension without incurring a tax charge. Web This measure applies to all members of registered pension schemes. Pay tax if you go above your lifetime allowance.

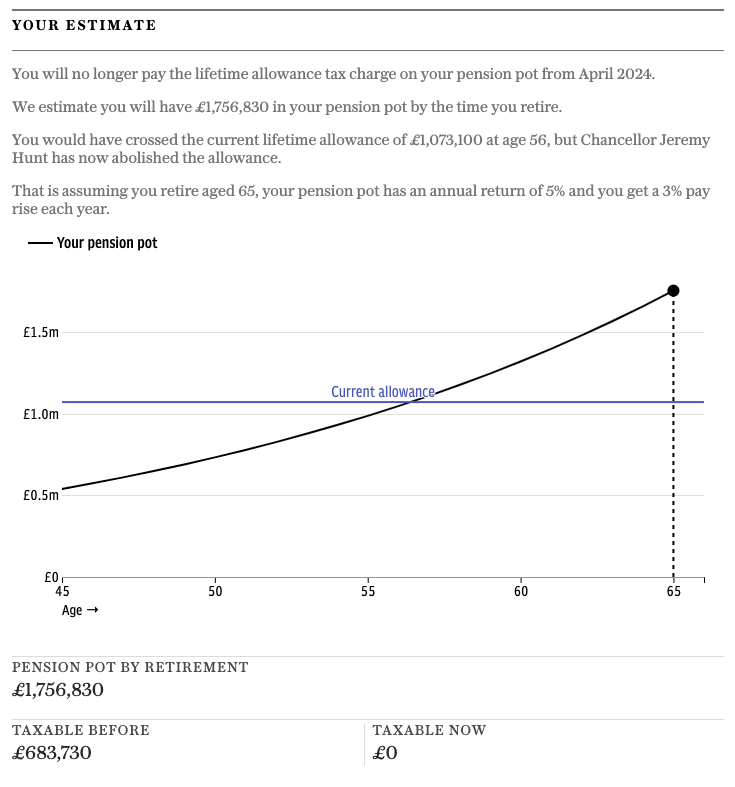

Web 1 day agoThe big surprise in Hunts speech was scrapping the lifetime allowance on pension pots from April which has limited the amount saved before tax charges apply. General description of the measure. Web Standard lifetime allowance.

Web The lifetime allowance is the total value of all pension benefits you can have without having to pay extra tax. There is no limit on the benefits an individual can receive - or crystallise - from registered pension schemes. Web In 2022-23 the lifetime allowance remained at 1073m and it is now frozen until 2026.

Your pension provider or administrator should deduct. It means people will be allowed to put aside as much as they can in their private scheme without being taxed - removing the 107m limit. Web The lifetime allowance for pensions LTA is set at 1073100 for the current tax year.

Web Key facts The lifetime allowance is the maximum value of benefits that can be taken from a registered pension scheme without being. Web Charges if you exceed the lifetime allowance Lump sums. Web 1 day agoCurrently the lifetime allowance caps the total amount a person can save in a pension without having to pay an additional tax charge.

Mr Hunt will outline his Spring Budget to Parliament on. Web For 2023 the lifetime gift tax exemption as 1292 million. Under previous plans the lifetime allowance was due to.

For married couples both spouses get the 1292 million exemption. Web Lifetime Allowance rules what do you need to know. Web 1 day agoThe lifetime allowance is abolished and annual cap is hiked to 60000 but theres a tax-free lump sum catch.

Web Your lifetime allowance LTA is the maximum amount you can draw from pensions workplace or personal in your lifetime without paying extra tax. It has been frozen at 1073m since the 202021 tax year and has. Best selling funds and trusts of 2023.

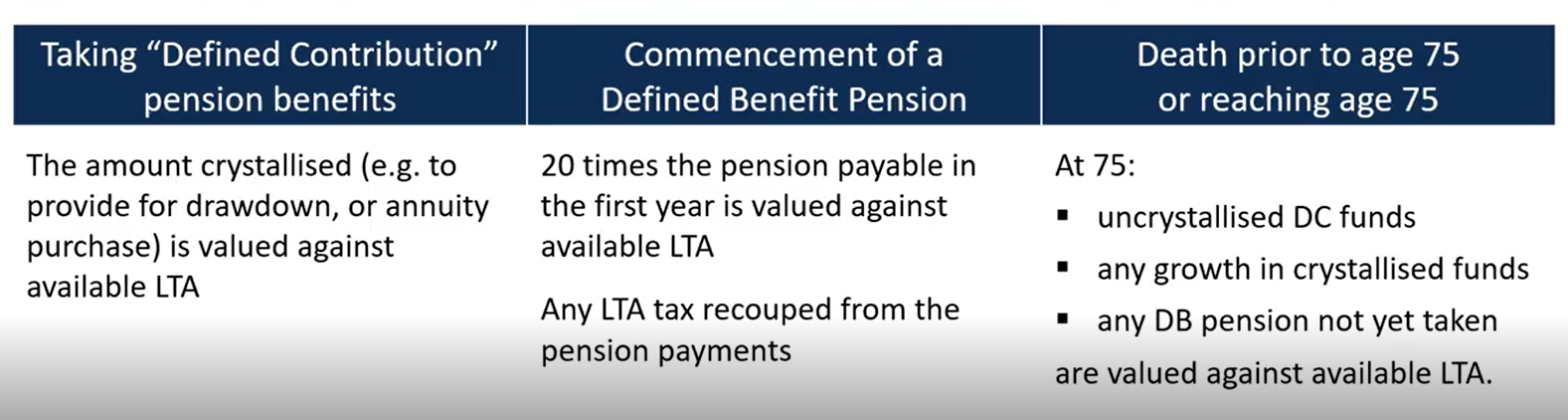

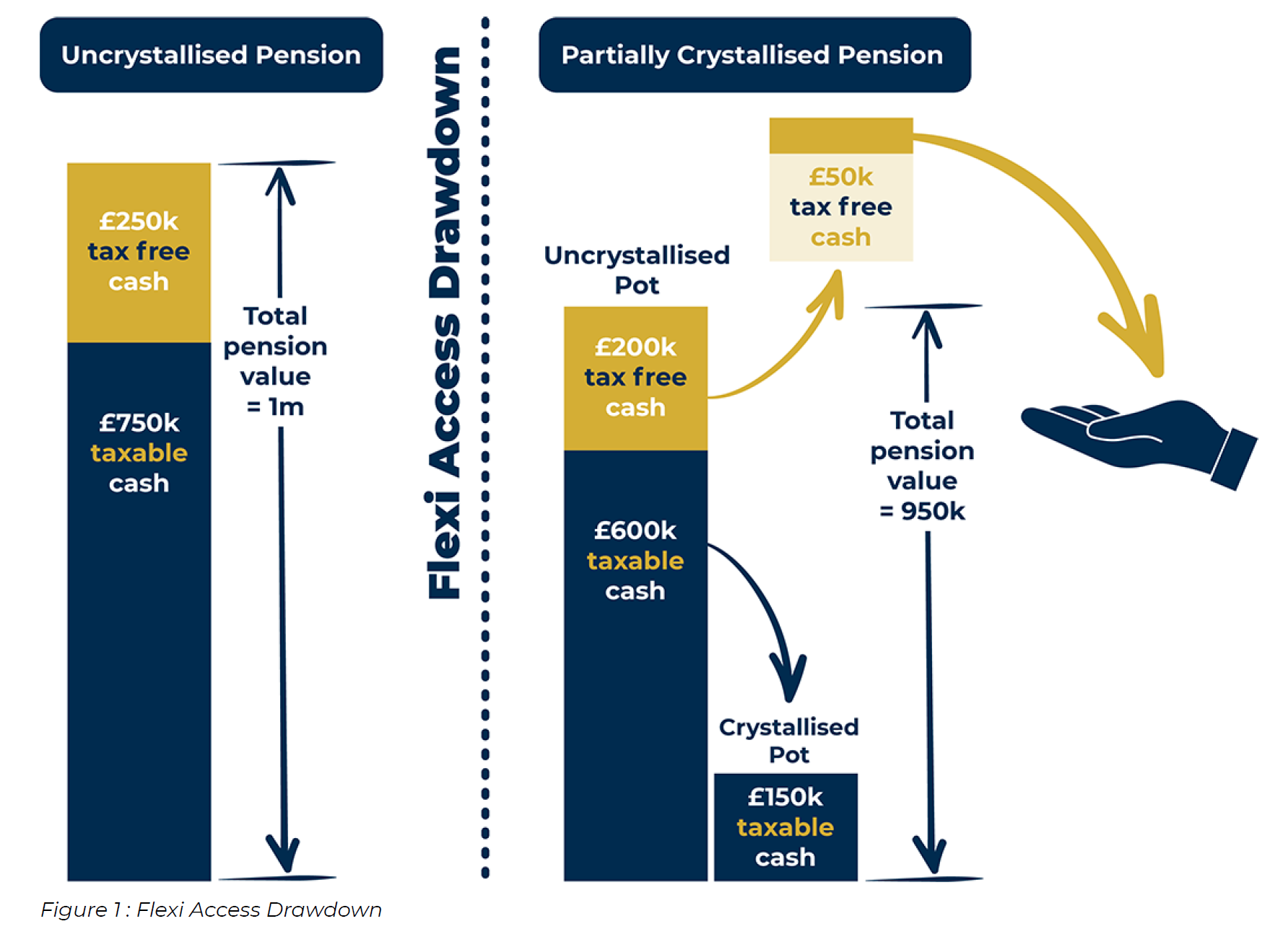

The current lifetime allowance is. Each time you take payment of a pension you use up a percentage of the lifetime allowance. When a member takes certain benefits and at some other times such as attaining the age of 75 or on death before 75.

Web The lifetime allowance LTA is a limit on what can be taken out of registered pension schemes without an LTA tax charge. This figure is currently 1073100. From 6 April 2023 it removes the Lifetime Allowance LTA charge and limits the pension commencement lump sum PCLS to its.

The maximum Pension Commencement Lump Sum for those without protections will be retained at its current level of 268275 and will be frozen thereafter. Protect your lifetime allowance. If you keep the money in the pension so you can take an income from it either flexibly pension drawdown as.

Web 1 day agoThe government will remove the Lifetime Allowance charge from 6 April 2023 before fully abolishing the Lifetime Allowance in a future Finance Bill. Key facts The lifetime allowance is the maximum value of benefits that can be taken from a registered pension scheme without being subject to the lifetime allowance charge. Web Lifetime allowance Check how much lifetime allowance youve used.

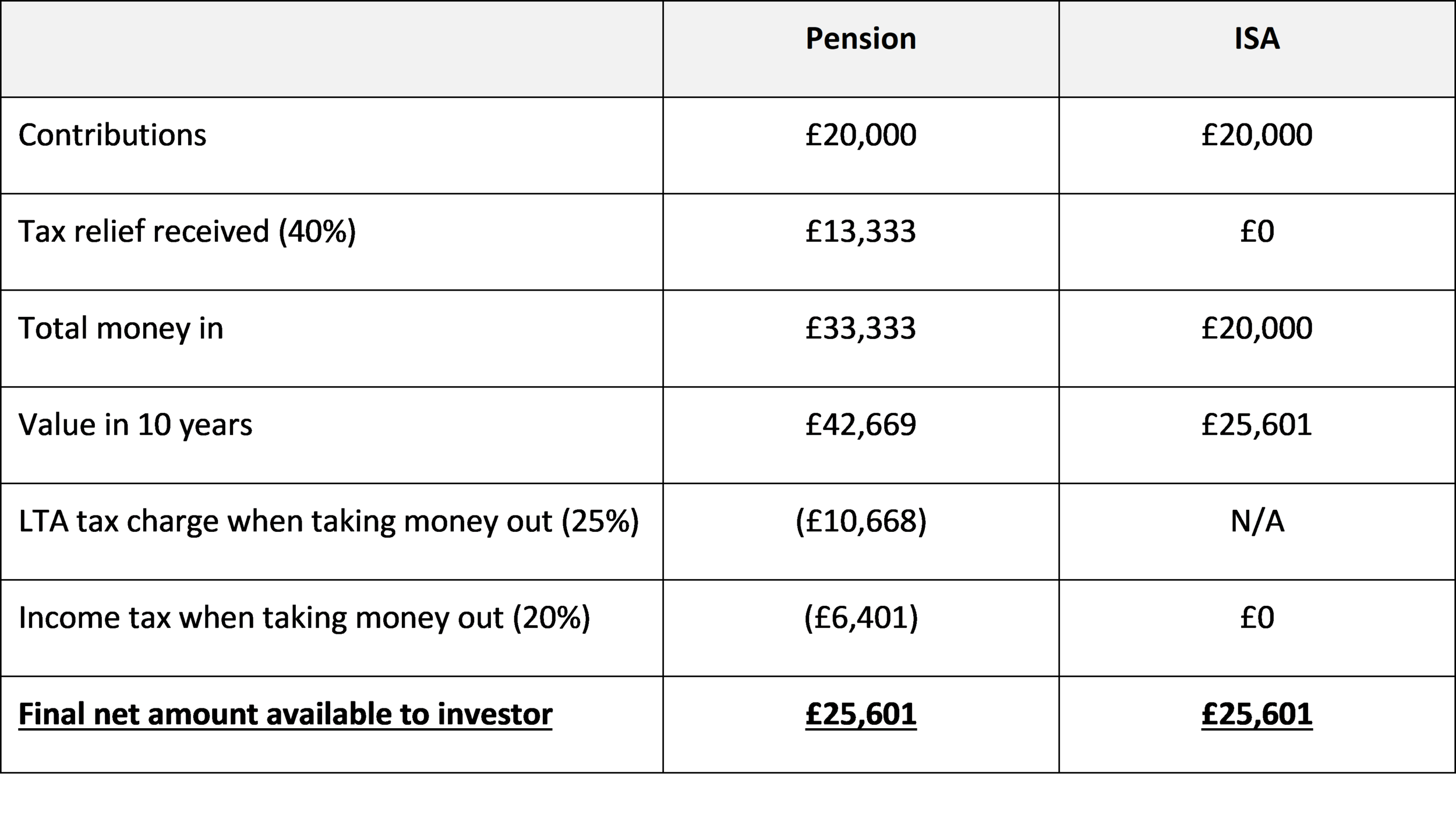

Web The lifetime allowance is the maximum amount of pension savings an individual can build up without a charge being applied when they take their benefits. The lifetime allowance limit 202223 The 1073100 figure is set by the government. If you take the excess as a lump sum its taxed at 55.

Web The lifetime allowance is the amount that someone can save in total for their private pension without incurring a tax charge. Benefits are only tested against the lifetime allowance when a benefit crystallisation event happens. Individuals whose total UK tax relieved pension savings are near to or more than.

Web 1 day agoChancellor Jeremy Hunt used his budget on Wednesday to announce the abolition of the lifetime pensions allowance. Web Currently the so-called lifetime allowance - the amount you can accumulate in your pension pot before extra tax charges - is 107m. It applies to your workplace pension s and any private or personal pensions but does not include the state pension.

This measure removes the annual link to the Consumer Price Index increase. Where investors are putting their money ahead. Youll get a statement from your pension provider telling you how much.

This is how the Pension Lifetime Allowance has changed since 2006. The history of standard lifetime allowance for the different tax years from 200607. This means that you can give up to 1292 million in gifts over the course of your lifetime without ever having to pay gift tax on it.

Web The lifetime allowance is one of two which set how much you can pay into your pension before getting penalised with tax. It may be possible to protect benefits in excess of the lifetime. Web Pension Lifetime Allowance changed in April 2016 and action needs to be taken by people with pensions likely to be greater than 1000000 so that they can avoid having taxes imposed later.

The lifetime allowance is set. Web The current lifetime pension allowance LTA currently stands at 107m meaning those with money in their pension pot incur tax only after that threshold has been reached.

Lifetime Allowance Lta Frozen For Five Years

How To Manage The Lifetime Allowance To Your Advantage Netwealth

Should I Fear The Lifetime Allowance Legal Medical Investments Financial Advisers

Mlakqm4smqfhem

So6az5mrp331pm

How To Pass The Cii R04 Demystifying The Annual Allowance And Lifetime Allowance

1uuqbdv2buutum

Aegon Welcomes Speculation That Chancellor Is Reviewing Pension Tax Allowances Ifa Magazine

W1opnggeci0mfm

G0kkvyk7lhob1m

Pension Lifetime Allowance Lta Uk Pension Help

Lifetime Allowance Charge Royal London For Advisers

Gmhdponwut Tym

Uk Shadow Chancellor Set To Overturn Lifetime Allowance Abolition International Adviser

Should I Stop Paying Into My Pension If It Exceeds The Lifetime Allowance Atticus Financial Planning

Qgmeyopx26cc3m

Iap5vvuzauejlm